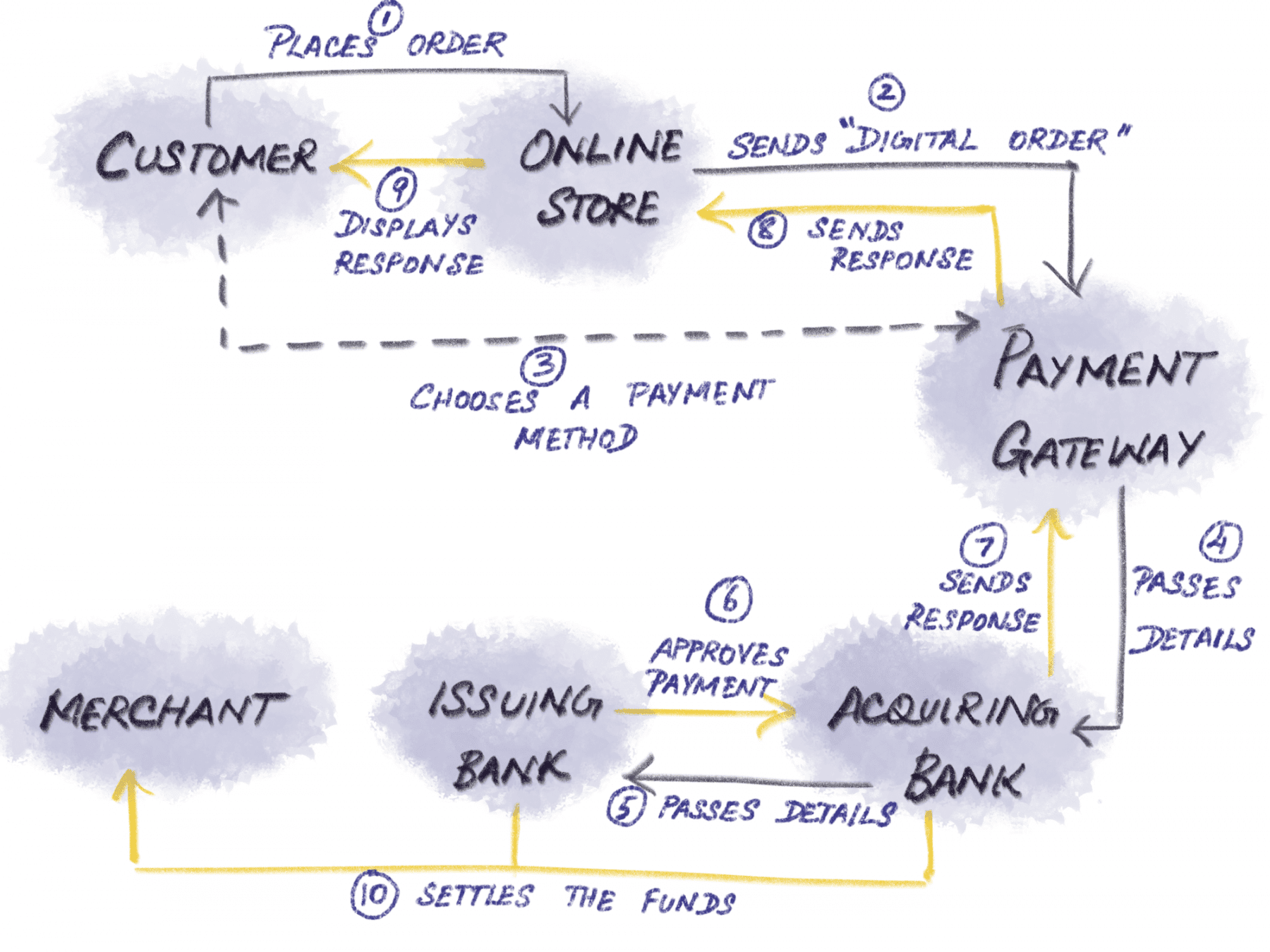

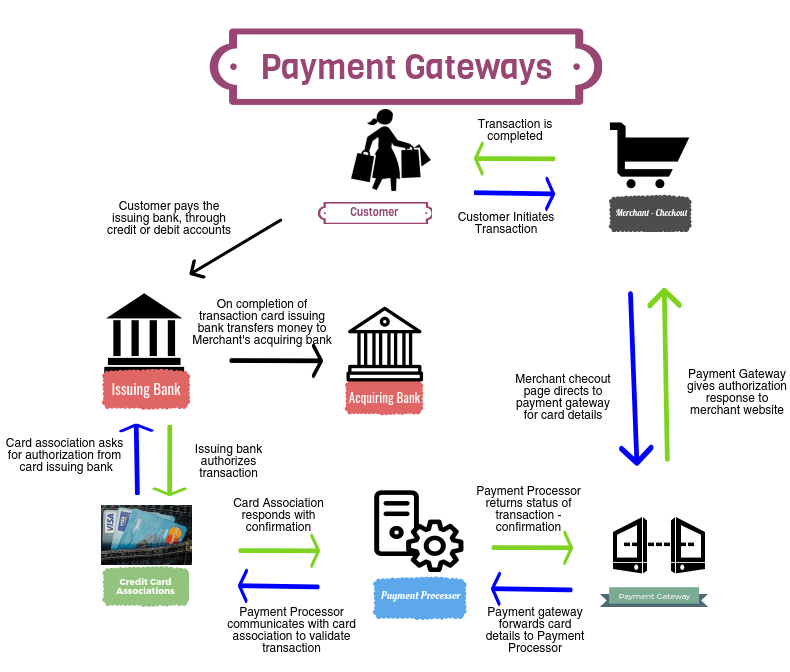

You have the option to choose between two different account types:Ī merchant account is an account that allows you – the merchant – to accept debit, credit, and electronic payments. Remember all the parties involved in a transaction? A traditional bank account is a repository for money it doesn’t have the capabilities to verify and authorize the transfer of funds across so many networks. You might wonder why can’t just link your business bank account with a payment processing company. But you can only use your traditional business bank account to accept cash and checks if you want to accept other forms of payment, you’ll need a merchant account in addition to your traditional business bank account. Types of Payment Processing AccountsĪs you’ve probably figured out, you can’t just start accepting credit cards without setting up an account. Just remember that there are a lot of parties involved in a transaction – you, the processing company, the issuing bank, and the acquiring bank – and the job of the payment processing company is to enable accurate communication of data between all parties.

There’s a lot more that goes on beneath the surface of a transaction, but you don’t need to know every detail of how it works. This is a simplified account of a very complex process.

But you need to understand what goes on behind the scenes to understand the pricing structures and security features of payment processors that we will go over later. Understanding Payment ProcessingĪs a business owner, you likely have some understanding of how credit and debit cards work.

#Payment processing how to#

Gain the knowledge and confidence to decide if you need a payment service provider or a merchant account and how to negotiate a contract with a payment processor.

#Payment processing free#

The payment processor you choose affects everything from your ability to collect payments, to your customer service, to your business’s bottom line.Ī few of the main topics we’ll cover include (feel free to skip ahead): Since payment processing has a direct effect on your revenue, it is especially important to make informed decisions. Whether you’re a new business that has never accepted a credit card before, or are trying to gain a better understanding of the latest developments in payment processing, like NFC and MobilePay, this guide will answer your questions.

0 kommentar(er)

0 kommentar(er)